colorado real estate taxes

It is important that you notify us if there is a. The Treasurers Office mails tax statementspostcard notifications in January.

Appeal Denver Property Tax Assessment Appeal Denver Property Tax Assessment

Property tax notices are mailed before the end of January to the owner of record which is the name and mailing address listed on the Tax Roll at the time of the Assessors.

. Property Owner Address Change. If youve already filed your Colorado state income tax return youre all set. Three cities in Colorado also have a local income tax.

Coloradans are facing massive property tax increases in the coming years due to a combination of the states surging real estate market the tax systems biennial assessment. Another law will temporarily lower property tax rates for tax years 2022 and 2023. The taxes owed for apartment properties would be reduced by about 5 percent.

Colorado Cash Back. State assessed and business personal property information can be obtained by calling our office. Our free Colorado paycheck calculator can help figure out what your take.

Only real estate and mobile home taxes are accessible online. Youll receive your Colorado Cash Back check in the mail soon. Using a 1031 Exchange to Defer Taxes in Colorado.

The Assessors Office calculates the amount of those taxes. A 1031 exchange allows you to defer paying capital gains tax on the sale of your property if you reinvest the proceeds into a. Pay your real estate taxes and your business personal property taxes in one full payment or in first- and second-half installments where applicable.

The Treasurers Office is responsible for the collection of all real estate personal property manufactured housing and state assessed taxes. We do not mail property tax notices to mortgage companies. The median property tax in Colorado is 143700 per year for a home worth the median value of 23780000.

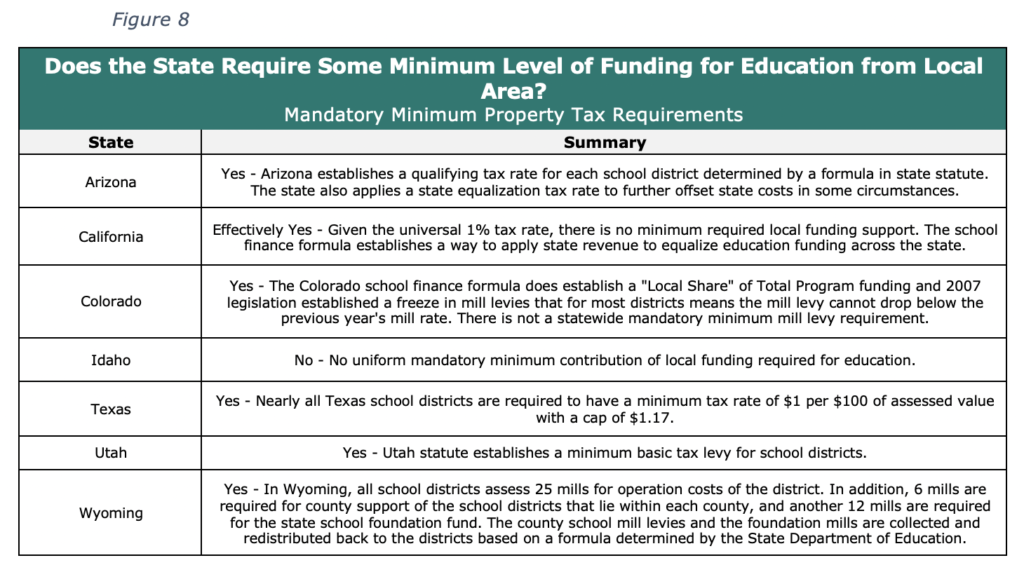

2021 Mill Levies by Tax District. Colorado has a flat income tax rate of 450. If you own a home in the Centennial State you pay 063 of your.

2021 Abstract of Assessment. Personal property tax enforcement is accomplished by seizing and selling the property when necessary. The Treasurers Office collects taxes for real property mobile homes and business personal property.

We are located on the first floor of the. Counties in Colorado collect an average of 06 of a propertys assesed fair. Senior Property Tax Exemption.

Summit County Fiscal Office Kristen M. The low percentage of property taxes compared to the total revenue collected indicates a state with low property tax rates.

U S Cities With The Highest Property Taxes

Don T Get Overtaxed A Guide To Colorado Property Taxes And Appeals In 2021 Faegre Drinker Biddle Reath Llp Jdsupra

Summit County Real Estate Transfer Taxes

Colorado Property Tax Increase To Be Capped For Two Years Under Bill

Understanding Your Property Taxes Springs Homes

Protest Your Property Taxes By May 15 Nail Key

Property Taxes By State Highest To Lowest Rocket Mortgage

My Property Taxes Went Up 20 And Yours Went Up The Same Or More Colorado Hard Money Lender

The Ultimate Guide To Colorado Real Estate Taxes Clever Real Estate

Property Tax Calculator Smartasset

Colorado To Cut Property Taxes Temporarily Ke Andrews

A Guide To Property Taxes At Home Colorado Real Estate

Colorado S Property Taxes Among Lowest In Nation Study Lakewood Co Patch

Colorado Estate Tax Do I Need To Worry Brestel Bucar

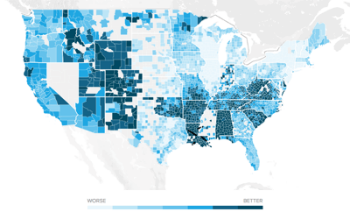

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

Despite Growing Property Taxes Jeffco Schools Budget Limited By State Jeffco Pen